What is unsecured debt?

Unsecured debt and credit cards can be powerful tools to transform one’s finances and increase a person’s income, but they can also be a nightmare if misused. Unsecured debt, by definition, refers to any debt “not backed or guaranteed” by using collateral, such as a house or a car. If you cannot repay the debt with a secured loan, the lender can automatically seize your assets to pay off the debt.

Instead, the lenders of unsecured loans may take legal action to recover a debt but need a court order to take any of your property. For example, with credit card debt, creditors may issue a credit card summons. If a debtor skips their court appearance or loses the case, the creditor could proceed to obtain a default judgment, a step required before creditors can attempt to issue a wage garnishment order or seize property. There are exceptions to this rule, as we’ll explain in the following blog post.

Examples of unsecured debt include:

-

- Credit card debt.

- Medical bills.

- Personal loans.

- Student loans (with some exceptions).

- Some types of business loans.

Because there is no collateral backing unsecured debt, lenders may charge higher interest rates than they would for secured debt. Additionally, unsecured debt is often considered riskier for lenders. Consequently, creditors may have stricter qualification requirements for borrowers, such as higher credit scores or shorter repayment terms.

In the Following Unsecured Credit and Debt Guide, You Will Learn–

- How to use unsecured debt and credit cards in the most beneficial ways

- The differences between secured VS. unsecured debt

- How to qualify for unsecured loans

- About Credit Reports and Scores; including how to hack a high credit score quickly

- How to use unsecured credit cards to earn thousands of dollars of additional income every year (Tax-Free)

- Strategies to avoid ever paying a dime in interest

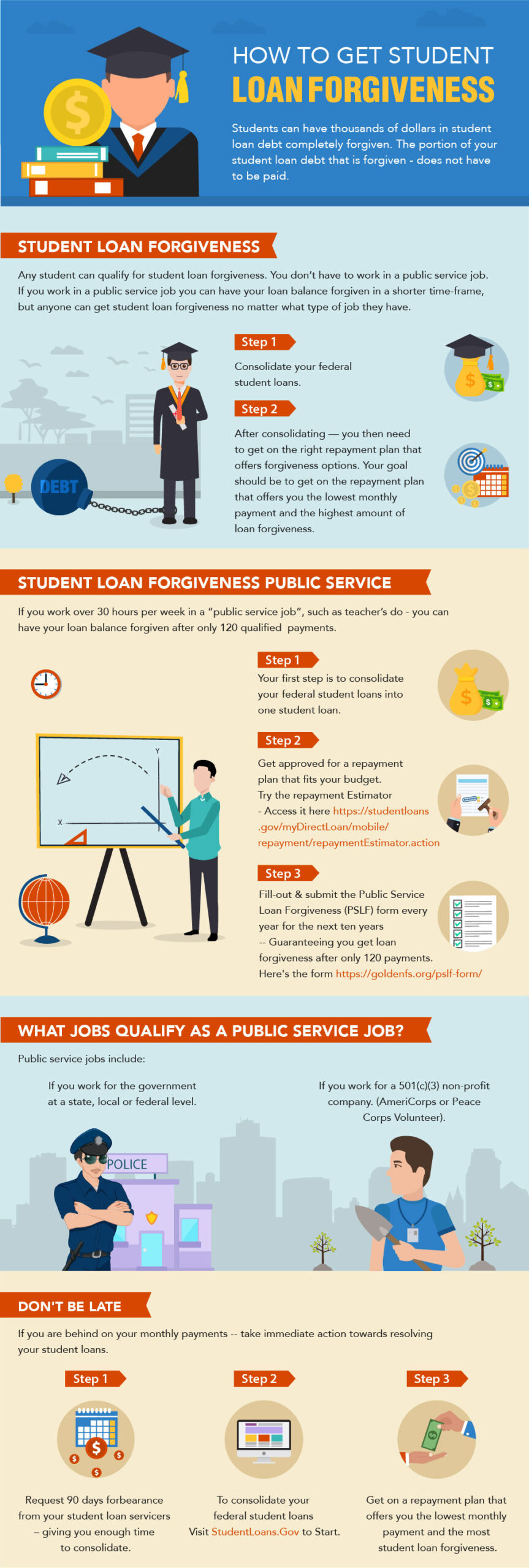

- Debt relief options, including how to get student loan forgiveness

- and much more

And NO gimmicks, just “basic finance 101”.

How to Qualify for Unsecured Loans

The information on your credit report, such as your credit history and score, determines if you’re eligible for “unsecured credit” – like getting a credit card or an unsecured personal loan. For example, if you qualify for an unsecured credit card, your credit history and score will determine how much of a credit limit you get approved for.

If you have a low credit score with derogatory information on your credit report, such as late and collection marks, to get approved for a credit card or loan, creditors may require collateral. Your car, house, or even cash can be collateral. When using collateral to guarantee payment on a credit card or loan, it’s called a secured loan or credit card.

If you fail to pay your monthly payment on a secured debt on time and follow the terms of the credit card or loan contract, the creditor can legally take whatever asset you put up as collateral.

If you have an unsecured loan and stop making your monthly payments on it, the creditor cannot take any of your assets, including your home or vehicle, so your property is protected; unless they first bring you to court, sue you, and win (i.e., winning is getting a default judgment).

An exception to this rule is with a federal student loan.

Can wages get garnished over federal student loans?

Federal student loans are unsecured debts. However, if you fall behind on your federal student loan payments, the Department of Education can garnish up to 15% of your disposable income without taking you to court.

You can call this an “excessive use of government power.” Shame on the government for taking advantage of its power!

Need Student Loan Forgiveness? (See Step-by-Step Instructions)

Unsecured Debt Examples:

- credit cards

- private and federal student loans

- unsecured bank loans

- medical bills

- debt consolidation loans

Unsecured vs. Secured Credit Cards

To understand an unsecured credit card, let’s first talk about a secured credit card.

When a person gets their first credit card, they often start with a secured credit card because it’s easier to get approved since you are putting up collateral. Unless you use “The Piggyback Trick to Hack a High Credit Score.”

But for most people – Your first credit card will be a secured credit card, where the bank guarantees the card with cash.

Suppose you get a secured credit card with a $500 credit limit. You must give the bank $500 to guarantee payment on that card even if you stop paying the card’s monthly payments.

You are not required to put up collateral when you get an unsecured credit card. Instead, you get the unsecured credit card by signing a piece of paper. Remember that that piece of paper includes your social security number and signature agreeing to specific terms. And if you violate those terms, like being late on credit card payments, your credit report can be damaged, preventing you from obtaining credit again for many years ahead.

Rick Sorrentino, a Credit Expert and Senior Account Executive at Beyond Finance, explains;

“If you aren’t using credit to make money, you are using it wrong & should call it exactly what it is…debt. Creditors won’t call it a ‘debt card’ or state what your ‘debt limit’ is because psychologically, ‘credit’ sounds so much better, but the fact is, when you’re dealing with the effects, you know you’re dealing with DEBT.”

Open-End vs. Closed-End Accounts

A credit card is an open-end account; it stays open for as long as you want. There are closed-end accounts, like an installment loans, and open-end accounts, like credit cards and home equity lines of credit.

You can continue using an open-end account for eternity if you choose to. We talk more about open and closed-end accounts in the later chapters.

A loan is a “credit” — money that can be used to purchase items. A debt is a bill – a balance that you must pay.

Unsecured Debt Consolidation Loans

Debt consolidation loans are another unsecured loan used to consolidate debt and save money. People get a low-interest loan to pay off debts that have high-interest rates, leaving them with one low-interest loan to pay back.

Before getting a personal loan to consolidate debt, check out online reviews about companies. Find a debt consolidation company licensed, accredited, and highly rated at the BBB. Also, compare the cost of debt consolidation loans with multiple lenders.

NoMoreCreditCards.com debt consolidation reviews make it easy to compare lenders. Check out some of our recent reviews!

Recent debt consolidation reviews:

Positives for Unsecured Loans

- An unsecured loan has a shorter repayment term.

- An unsecured loan doesn’t put an asset at risk of being taken.

- Positive payment history on an unsecured credit card will increase your credit score faster than on a secured credit card.

- Unsecured debt gets dismissed in a Chapter 7 bankruptcy, so you don’t have to pay it.

The downside of Unsecured Loans:

- An unsecured loan comes with a higher interest rate.

- An unsecured loan is harder to get approved for.

- An unsecured loan offers no tax benefits.

- Lenders will provide you with higher loan amounts with secured loans.

Benefits of Secured Debt:

- Tax benefits! You can deduct the interest from your mortgage and home equity loan payments from your federal taxes.

- A home equity line of credit is a secured debt. Home equity lines of credit have the lowest interest rate and offer the lowest monthly payment term compared to any other type of loan.

- You are guaranteed to get a secured credit card — just put up the cash — and the bank and credit card company will approve you.

- Lower interest rates are on secured debts, such as your home and car loans — because creditors see you as a “low-risk” — since they have a “guarantee of payment”.

Downsides of Secured Debt:

- After filing for Chapter 7 bankruptcy, your secured debts still need to get paid off if you want to keep the property.

- If you fall behind on monthly payments, you will get hit double — 1st, your credit takes a hit, and 2nd, your collateral is taken away.

What is a Secured Credit Card?

A secured credit card helps establish credit. Anyone can get a secured credit card by putting up collateral, even with bad credit. Collateral, in this case, is “cash” (security deposit). The bank will put your security deposit into an account they control. This guarantees that if you fail to make your monthly payments, the bank can take your cash to get reimbursed.

You would then lose the money (your security deposit), and your credit report would be negatively affected. Falling behind on a secured credit card payment is one of the worst mistakes that young people make. “Some issuers will keep your security deposit in an interest-bearing account. For example, USAA will keep the money in a 2-year COD (Certificate of Deposit) that earns interest at a variable rate.”

Secured credit cards are a great tool to help young students build positive credit history.

Examples of Secured Debts

- Mortgage

- Car payment

- A home equity line of credit

- Business loans that “are guaranteed” by your company’s “accounts receivable” (i.e., money that your customers pay you)

- Bank or finance company loans that require collateral.

Learn How to HACK High Credit Limits & Increase Your Income with Cash Back

Let’s start from scratch; If you’re new to the world of credit, here’s what you want to do:

First, start with a secured credit card.

Certain credit cards pay 2% or more in cash back on every purchase you make. Go to WiseBread.com and find the best credit card that fits your lifestyle.

Use your secured credit card whenever you need gas and groceries to get paid cash back for each purchase.

Unfortunately, secured cards have more restrictions than unsecured credit cards, but still – shop around – and find a secured credit card that pays you the best and has no annual fees. Eventually, this secured card will convert to an unsecured card, and you may have it for the rest of your life.

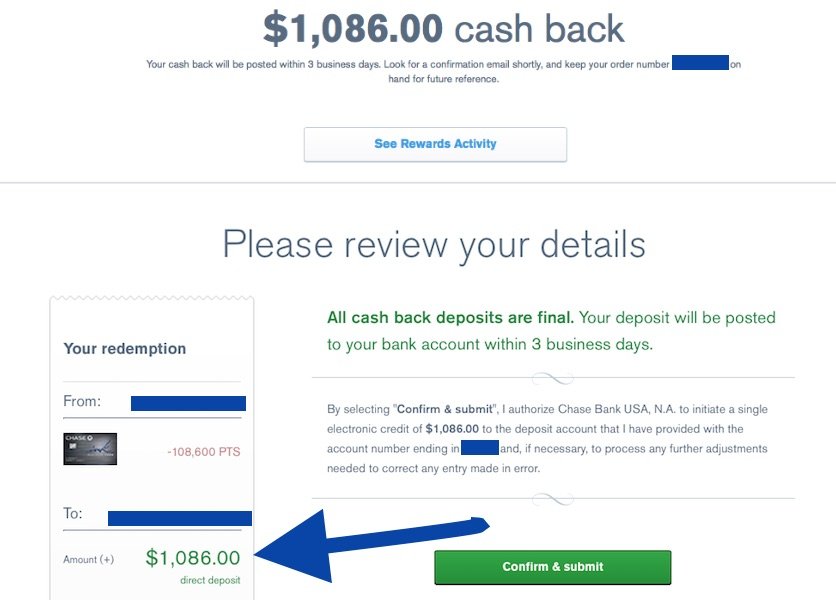

Use Unsecured Credit Cards To Earn Thousands of Dollars Per Year (Tax-Free) & Increase Your Income

Instead of using a debit card and paying the full price for purchases, use your credit card for all purchases and get extra savings.

Every month your credit card company will deposit money into your bank account.

The best part about cash-back on credit cards is that it’s “tax-free.”

At BankRate.com they explain that; “The IRS thinks of the rewards as a discount on the purchase.”

Therefore, take your time when selecting a credit card. Some cards pay you 1% on only certain purchases, while other cards may pay you 2-3% on all purchases.

Don’t forget these next words of financial wisdom –

The more you use your credit card and pay the balance in full every month, the faster your credit score and credit limit will rise. And you’ll never pay a dime in interest if you pay your balance in full at the end of every month. Don’t wait until your statement balance arrives, pay the balance in full before your statement even comes. If you pay your balance in full twice per month, instead of just one time per month – you will show more credit usage, and you will establish better payment history in a quicker time-frame. Don’t pay the statement balance, pay the pending balance as well, so that there is no balance left.

Yes! We are about to show you how to “HACK” high credit limits.

Even if you’ve just started on the path of building your credit score and you only have a secured credit card, you can quickly have a high credit score. After nine months of using your secured credit card at least once per week, and paying your balance in full two times per month, your credit score will rise quickly.

After nine months of using your card at least once per week and paying your balance in full two times per month, now is a good time to request–

- A.) the credit card company to switch your “secured card” to an “unsecured card” and,

- B.) a credit limit increase by at least $500 to $1000.

Your creditor will approve this request because of the past nine months of responsible credit usage and flawless payment history — proving that you are “credit-worthy.”

Continue this process. Every 9-12 months after using a card weekly and paying the balance in full at least 1-2 times per month, request another credit limit increase. As your available credit increases, so will your credit score because your credit utilization ratio continues to improve, hacking a high credit score quickly.

According to Experian.com directly, “Even if you’re not behind on your bills, having a high balance on revolving credit accounts can lead to a high credit utilization rate and hurt your scores. Revolving accounts include credit cards and lines of credit, and maintaining a low balance on them relative to their credit limits can help you improve your scores. Those with the highest credit scores tend to keep their credit utilization ratio in the low single digits.”

Source: Experian, March 29th, 2023

After one year of using your card weekly, and paying the balance two times per month in full, apply for a second card. You can do this every year for five years. After five years, you’ll have five cards and that’s an optimal number of cards to carry.

Creditors like to see that you can responsibly manage multiple credit cards and different types of credit as well including car and mortgage loans. But don’t make the mistake of falling victim to credit card debt, not being able to resist spending more than what you can afford to pay in full that same month that the purchase is made. Banks give credit limit increases wanting people to spend more money and carry higher credit card balances from month to month because that allows them to earn more interest and fees. As long as you continue making at least the minimum required monthly payment – the more debt you have – the better the bank’s profit margins will be.

Applying for a second credit card

When you apply for your second unsecured credit card, request a $2,000 limit from the start. Any credit card company or bank should approve it, as they can see your credit score has been growing over the last year.

Follow the cycle, use and pay the balance in full two times per month. After six to twelve months of using and paying your second credit card twice per month, and of course, continuing to do the same on your first card as well – ask for the increase in your credit limit from $2,000 to $3000-$5,000 on the second card.

Exception: If you have no income, they probably won’t approve the increase even if you’ve maintained this perfect credit usage and payment history.

Once they raise your limit on the second credit card, continue the process, using your card every month and paying the balance, not one, but two times per month in full.

Try to alternate which card you use each time you go to the store, a restaurant or buy gas. Have a specific set of cards that offer you different benefits, depending on your lifestyle and where you spend money.

At the two-year mark, get a third credit card. Again, start with a $2,000 limit. Use the credit card every month. And continue using your other credit cards.

This exact process continues until you have five credit cards. By the time, you have five credit cards and have followed this path precisely as I am instructing you to do – Your Credit Score Should Be Above 800 At This Point!

What is Closed-End Credit?

Closed-end credit (e.g., an installment loan) is when you borrow a fixed amount of funds; and must repay the loan, plus interest and fees, all within a specified period. Closed-end credit is most commonly used to make large purchases.

With a closed-end account, your account gets closed after you make all your agreed-upon monthly payments.

Example of a closed-end credit: A car loan and a real estate loan are examples of closed-end credit. Car loans don’t stay open after they are paid in full like credit cards, where a person can continue charging on that account. Instead, the loan becomes a closed account after a person pays off their car loan.

If you pay more than your agreed-upon monthly payments on a closed-end account, lenders will often charge you an extra fee that they call a “pre-penalty fee.”

Warning: Ask your lender if you plan to pay extra towards your mortgage or car payment to ensure the additional funds go towards the principal, not interest or a pre-payment penalty.

Installment loans, like car payments or mortgages, are excellent tools to increase your credit score.

Carry a mix of credit accounts in your credit portfolio to maximize how high you can get your credit score.

Always try to have at least one closed-end credit you’re paying for each month to keep your credit score as high as you can get it.

What is Open-End Credit?

Open-end credit is like a credit card or home equity line of credit:

- Open-end accounts can stay open for as long as you live.

- The terms can change over time (i.e., you can eventually get an increase in your credit limit).

- You can pay off your balance on an open-end account, like with a credit card, and continue charging on it again.

- You can save money on an open-end account by paying off the balance immediately to avoid paying interest charges.

Help With Unsecured Debt

Let’s end this blog post with some guidance on dealing with unsecured debt you can’t afford to pay. There are multiple debt relief programs to choose from as of 2023. Visit the NoMoreCreditCards.com Credit Card Relief and Unsecured Debt Relief Program page next to learn about debt relief options.