Credible.com Reviews: Is Credible Legit?

Are you considering using Credible for a personal loan?

This review of Credible Loans will provide you with all the necessary information to make an informed decision about your borrowing options.

Who is Credible?

Credible is a trusted and free online marketplace that provides consumers a quick and convenient way to apply for loans. Credible debt consolidation loans are also available, but the company doesn’t specialize in debt relief services.

Unlike many other online loan platforms, Credible does not offer payday loans and is not known for sub-prime high-interest loans. Instead, they specialize in low-interest debt consolidation loans, home loans, and private student loans.

What sets Credible apart is that their services are entirely free for consumers. They do not charge any fees to the borrowers. Instead, they earn revenue from the lenders once borrowers get approved for a loan. This means that Credible is fully invested in your success, as they only make money when you do.

To get a loan, start by visiting Credible.com. From there, the website instructs you on all of your options making it easy to apply for a loan and compare lenders within minutes.

In addition to their loan offerings, Credible’s student loan refinancing option has garnered high customer satisfaction ratings on various third-party review sites. This reflects the positive experiences of borrowers who have used Credible to refinance their student loans.

Are Credible personal loans legit?

Credible takes the time to carefully vet all the lenders in their marketplace, ensuring consumers can access the most reputable options. With approximately twenty lenders in their network, Credible prioritizes working with trusted partners.

One of the advantages of using Credible is that you won’t have to worry about your information being shared with countless random lenders. Credible is selective about its partnerships and strongly emphasizes protecting consumers’ private information.

Credible’s BBB review is excellent. BBB rates Credible A+. Is Credible Accredited? Yes, Credible is also BBB Accredited and a licensed lender in every state it operates.

Does Credible have BBB complaints? Credible does have some BBB complaints, but on average, much less than other similar online lenders. They have a total of 15 BBB complaints. Credible has resolved all 15 of these complaints, illustrating their dedication to having satisfied clients.

Credible vs. Avant

- Both platforms offer loans. However, Avant offers loans from $2,000 to $35,000. Credible offers loans from $600 to $100,000.

- Avant’s rates start at 9.95%.

- Credible’s loans start at 4.60%.

- Avant also offers credit cards. However, Avant credit cards cost $39 per year as its annual membership fee.

- Credible also offers student loans and student loan refinancing options. For student loan refinancing, student’s can check rates by clicking here.

Easy and Efficient Loan Comparison:

Credible.com simplifies the loan search process by allowing you to compare lenders, rates, and loan options for free. Whether you have excellent or bad credit, Credible provides pre-approved loan offers within minutes.

Their extensive network of reputable lenders, including Sofi, Avant, Upstart, and more, ensures you’ll find the best loan for your needs.

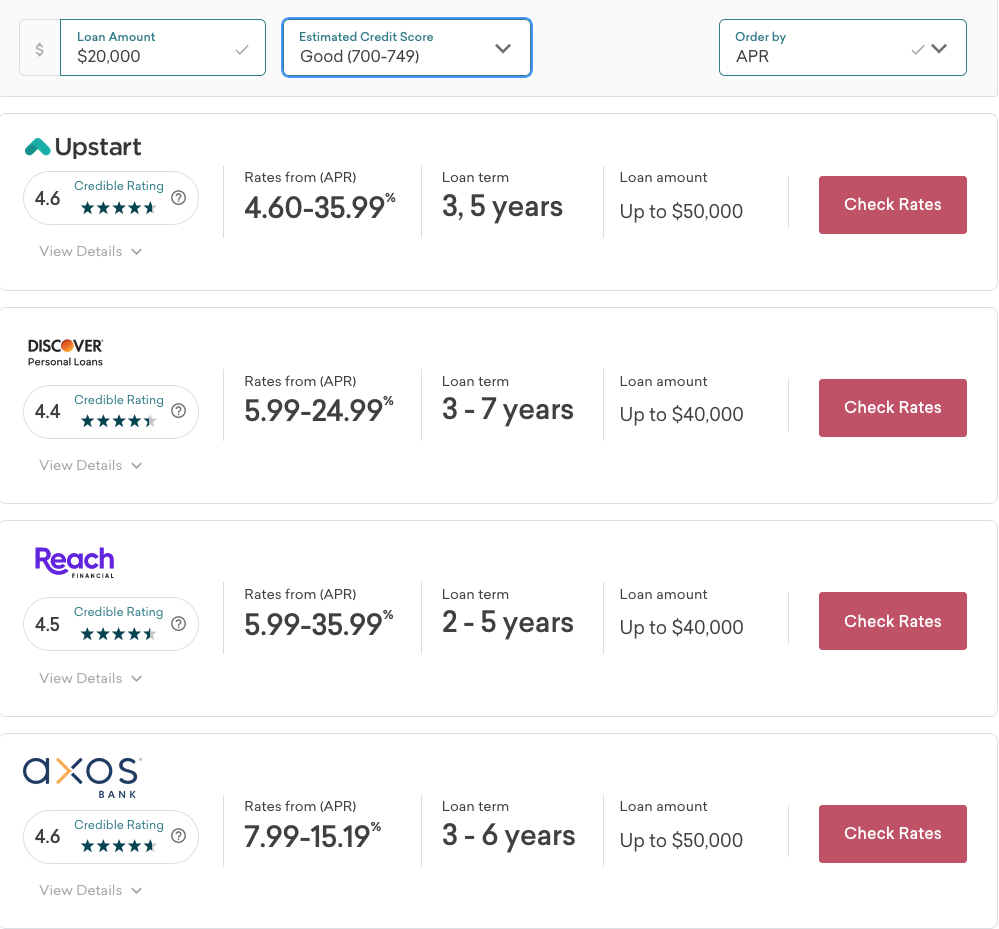

Next, let’s take a closer look at Credible loan terms, interest rates, and APR. We’ll help you explore both loans for bad and good credit.

Review Credible’s APR on Loans for Good Credit:

Image source: TrustedCompanyReviews.com, https://trustedcompanyreviews.com/finance/credible-personal-loan-review/

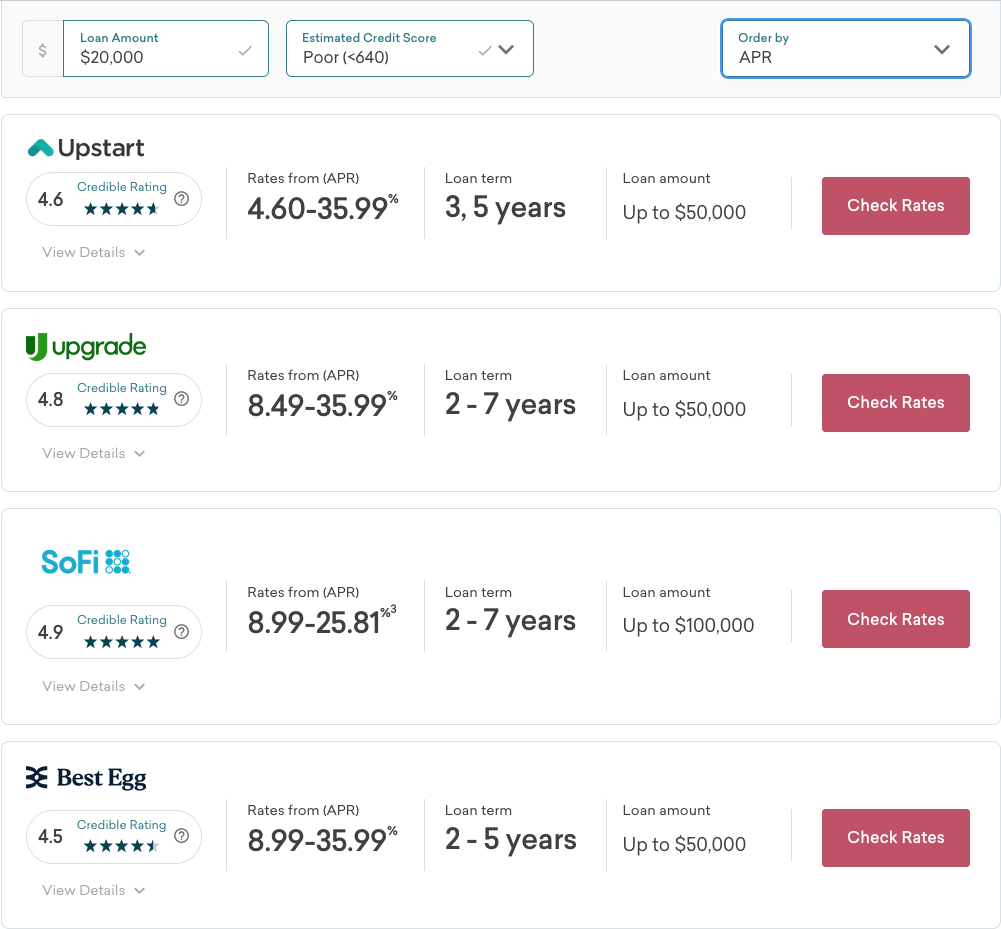

Bad Credit? Credible Loan APR and Terms

Image source: TrustedCompanyReviews.com, https://trustedcompanyreviews.com/finance/credible-personal-loan-review/

Complaints against Credible:

Credible has minimal complaints listed online and maintains high ratings on reputable platforms such as the Better Business Bureau (BBB) and regulatory agencies. All together, the BBB lists less than 15 complaints against Credible in the last three years. Keep in mind, Credible is a large organization, owned by Fox Corporation.

They are licensed in almost every state and offer student loans, personal loans and refinancing options.

What do customers say about Credible?

Customers on Reddit have shared positive experiences with Credible. One user mentioned that they received rate estimates from various lenders by completing a single form on Credible. Another user appreciated how Credible simplifies the loan application process, saving them from filling out multiple applications.

Credible Customer Reviews

Credible’s commitment to customer satisfaction is evident through its outstanding reviews and ratings. Customers praise Credible for its easy and streamlined process, competitive rates, transparent information, quick service, excellent customer support, and trustworthy platform.

TrustPilot.com reports 6,341 customer reviews about Credible, with an average customer rating of 4.7 out of 5. This is an exceptional rating! Consumers rave about how quick and easy it was to get a loan.

TrustedCompanyReviews.com rates Credible 4.6 out of 5 stars.

Based on Credible customer reviews it’s clear – they make it easier than any other online loan marketplace to get a loan by;

- 1.) working with the best-rated lenders,

- 2.) offering innovative technology and a user-friendly website, and

- 3.) offer different types of loans (e.g., bad credit, good credit, home loans, car loans and much more)

Minimum Credit Scores for Credible Loans:

Credible typically requires a minimum credit score of 700 for loan approval, although they also consider other factors. However, some borrowers with a credit score as low as 600 may still qualify. Verifiable income and a favorable debt-to-income ratio are essential considerations for Credible’s partner lenders.

Ideal Candidate for Credible Loans:

To have the best chances of approval, the ideal candidate for a Credible loan will possess a credit score of 700 or higher, a stable income, and a debt-to-income ratio of 40% or less.

Credible.com is your reliable source for personal loans, offering a streamlined process and access to multiple lenders. Consider Credible for your borrowing needs and make an informed decision that suits your financial situation.

Credible Loan Reviews BBB

Credible has gained a solid reputation in the lending industry, backed by trustworthy sources like the Better Business Bureau (BBB) and regulatory agencies.

With an A+ rating from the BBB and zero complaints filed with the NMLS, Credible’s legitimacy is unquestionable.

Furthermore, their average customer review rating of 4.6/5 stars on Trustpilot speaks volumes about their service quality.

Transparent and User-Friendly:

Credible’s platform is designed with user experience in mind. They provide transparent information about interest rates, fees, and repayment terms, ensuring transparency throughout the loan application process. You can also use their loan calculator to estimate monthly payments and assess the financial impact of different loan options.

Wide Range of Loan Uses:

Credible’s personal loans are versatile and can be used for various purposes. Whether you’re planning a wedding, covering medical expenses, consolidating credit cards, renovating your home, or starting a business, Credible has you covered. They even offer options for student loans and refinancing.

Pros and Cons of Credible Loans:

Pros:

- Compare personal loans from top-rated lenders quickly and easily

- Vast selection of reputable lenders at your fingertips

- No negative impact on your credit score during the pre-qualification process

- Innovative technology tailored to your financial needs

- Best rate guarantee with a $200 gift card if you find a better offer elsewhere

- Personal loans available for individuals with bad credit

Cons:

- Refinancing federal student loans with Credible may result in the loss of federal loan benefits, including loan forgiveness and income-driven repayment plans.

- Limited access to lenders outside of Credible’s partner network

- Pre-qualification does not guarantee loan approval

- Some lenders may charge origination fees

How to Get a Personal Loan with Credible:

- Visit Credible.com/Personal-Loan/.

- Enter your desired loan amount.

- Fill out a short online application with your personal and financial details.

- Get Credible’s pre-approved loan offers instantly and compare them side by side.

- Choose your loan and finalize the approval process with the lender.

- Receive funds in your bank account within 48 hours.

Safety and Privacy at Credible:

Credible takes your privacy and security seriously. Their website employs industry-standard encryption, and they do not sell your personal information to third parties. By partnering with reputable lenders and conducting rigorous due diligence, Credible ensures a safe and dependable lending experience.

Conclusion:

In conclusion, Credible.com is a reputable and reliable platform for anyone seeking a personal loan. Their user-friendly interface, extensive network of lenders, transparent loan terms, and commitment to customer satisfaction make them a top choice. With Credible, you can confidently compare loan options and find the best rates for your financial needs.