The 2023 Accredited Debt Relief Review

Drowning in debt can feel overwhelming. However, before enrolling in a debt relief service, be sure to compare all your options; understand how the program works, its pros and cons, fees and costs, and the company’s credentials. We also cover frequently asked questions about credit card debt relief in our Glossary.

To help you evaluate the Accredited Debt Relief debt settlement program, we researched and gathered information about Accredited Debt Relief, including details about costs and fees, their certifications and accreditations, and pros and cons to consider. Additionally, we share ratings and reviews about overall customer satisfaction that our team at NoMoreCreditCards.com uncovered while doing extensive research about the company.

Accredited Debt Relief Review: Key Takeaways

- One of the top two largest debt settlement companies in the nation, with over 500 employees

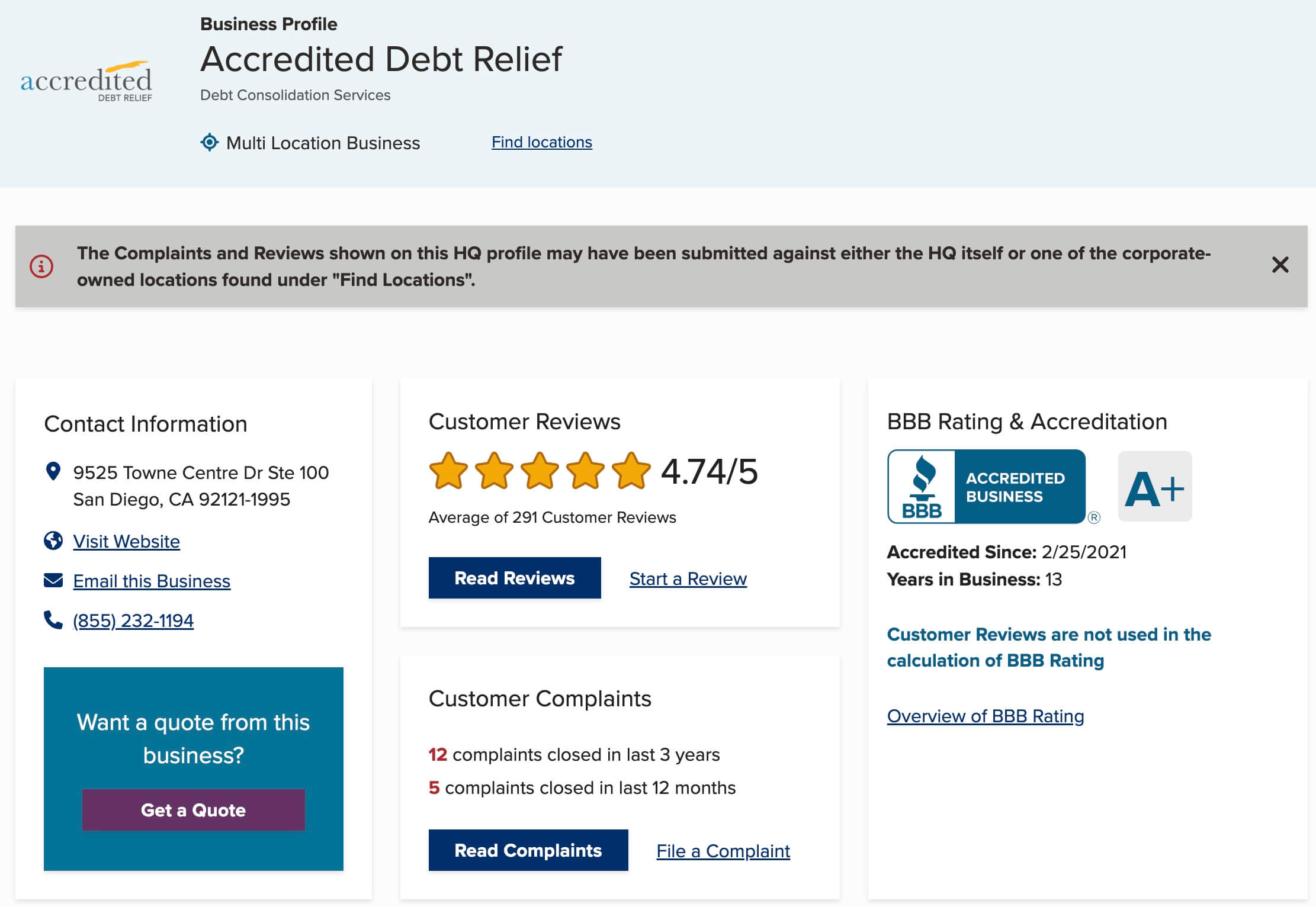

- Accredited Debt Relief has over 2,000 BBB reviews with an average rating of 4.74/5

- There are no fees charged on the Accredited Debt Relief program until after a debt is reduced and settled

- Qualified clients can get a consolidation loan while on the Accredited Debt Relief program that is used to settle each debt faster

Accredited Debt Relief Reviews and Complaints

National Debt Relief and Accredited Debt Relief are the two largest debt relief companies in the nation. Both of these companies are reputable organizations, A+ BBB rated and Accredited.

Accredited vs. National Debt Relief:

National Debt Relief has more BBB complaints.

Accredited Debt Relief has less than 15 complaints at the BBB from within the last three years. In comparison to the size of Accredited Debt Relief and the number of satisfied clients that they have, the number of dissatisfied clients comes out to less than 1%.

National Debt Relief’s BBB profile shows a total of 258 complaints. At BBB, National Debt Relief also has government action against them.

“On 6/01/2021, National Debt Relief, LLC was ordered to pay a civil penalty in the amount of $5,000 to the State of Minnesota by the Minnesota Dept. of Commerce for violations of Minnesota Statutes concerning debt settlement services. The company also agreed to cease and desist from violating any laws, rules, or orders related to the duties and responsibilities entrusted to the Commissioner of Commerce under Minnesota Statute Chapters 332A, 332B, and 45.”

National Debt Relief BBB customer reviews have an average rating of 4.64/5. Accredited Debt Relief BBB reviews have an average rating of 4.74/5. Both ratings are excellent.

Source: BBB, National Debt Relief

About Accredited Debt Relief

- Mission: “To provide debt relief options and savings for individuals and families struggling with debt across the U.S.”

- Website: www.AccreditedDebtRelief.com

- Address: 9525 Towne Centre Drive, Suite 100, San Diego, CA 92121

- Accredited Debt Relief Phone Number: 800-497-1965

- Licensed for debt settlement? Yes. Accredited Debt Relief is has options for debt consolidation in all 50 states and the District of Columbia.

- Certifications and Accreditations: American Fair Credit Council (AFCC), Better Business Bureau (BBB), International Association of Professional Debt Arbitrators (IAPDA)

What is Accredited Debt Relief?

Accredited Debt Relief, operated as a division of Beyond Finance, LLC, is a leading provider of debt consolidation services. With over 1,400 employees they are one of the largest debt settlement companies in the nation.

Accredited Debt Relief helps consumers pay off unsecured debt that they otherwise could not afford to pay. Through their debt resolution program, Accredited Debt Relief negotiates with creditors to reduce the principal balance owed.

What type of accounts qualify for Accredited Debt Relief?

Accredited Debt Relief can help if you have unsecured debts, which means debts that have no collateral attached to them, for example credit card debt. Debts with collateral attached, such as a car loan or a mortgage, are not eligible for our debt resolution program. Federal student loans also are not eligible.

How does Accredited Debt Relief Work?

Accredited Debt Relief’s program infrastructure is similar to others in the industry. To qualify, they require $10,000 or more in unsecured debt. Their streamlined consulting process will help you determine if you are eligible.

Step 1: Free Consultation The first step is a consultation with an IAPDA-certified debt counselor to learn about your options and check your eligibility for the debt settlement program.

Step 2: Review Credit Report: Your personalized plan starts with a free credit report. Together with you, the counselor will review your credit report and each debt on it, and determine if the accounts that you need help with qualify for the program.

Step 3: Personalized Plan If you qualify for the Accredited Debt Relief program, the counselor will prepare a personalized plan to help you get out of debt.

Step 4: Budget Analysis: The next step is a free budget analysis, to determine how much available cash flow you have at the end of each month. Based on this, your Accredited Debt Relief counselor helps you create a monthly payment plan that you can afford. They will then present a debt settlement program that gets you out of debt in one to four years. You may have more than one plan to choose from, depending on your budget.

Step 5: Approval for the Program: If you want to proceed with the program, you’ll receive a client enrollment agreement. Your debt specialist will go through that agreement with you page by page to ensure you understand all of the terms and conditions. After you review and sign the agreement, you’ll be approved for the program.

After Accredited Debt Relief starts:

Once in the program, you are responsible for depositing one reduced payment every month. This payment goes into a “special-purpose” savings account. This account is in your name and under your control. As funds accumulate in your savings account, the company’s debt negotiators will work with each of your creditors to solidify a settlement.

Clients are notified immediately when one of their debt negotiators gets an attractive settlement offer. Clients can either deny or approve the offer. If they approve the settlement offer, the creditor provides written documentation called a settlement letter, confirming that the one-time, reduced payment will result in “payment in full” or “settled in full.”

Accredited Debt Relief Settlements can save clients around 30% on each debt. In other words, you could resolve $10,000 in credit card debt for approximately $7,000, including all settlement fees, interest, and the principal balance. There’s no guarantee that you’ll save exactly 30%; the figures quoted will be estimated on past client results, so you may save a little more, or a little less.

The process continues, settling one debt at a time until you’re debt-free.

Accredited Debt Relief Extra Benefits:

- After making on-time debt settlement program payments for the first six months, clients can qualify for a loan. This loan, used to fund settlements, allows clients to get out of debt faster than planned.

- The program is success-based, meaning Accredited Debt Relief only charges a fee after achieving results.

- The program infrastructure is designed to provide clients with the best choices, results and savings.

Bad Credit Debt Settlement Loans

There are limited options available in the market for consumers with bad credit to qualify for loans. Accredited Debt Relief provides loan opportunities to clients, even if their credit is poor, considering alternative factors that conventional lenders typically overlook.

This includes the clients’ program payment history. For instance, in order to be eligible for a debt settlement loan, one of the prerequisites is that clients must have completed a minimum of 6-12 program payments on time.

For a debt settlement client, getting a loan to settle their debt faster offers tremendous value. Clients can get out of debt in as quickly as 18 months or less, and all while having one low monthly payment.

Accredited Debt Relief Reviews and Complaints

Our extensive research on Accredited Debt Relief gathered less than twenty complaints online, unusual for a company of this size in the debt relief industry.

Many online reviews mention their excellent customer service and communication with clients, making it a smooth process.

Other Accredited Debt Relief reviews online, including TrustPilot, Consumer Affairs, and Investopedia, all have an average customer rating that’s close to five out five stars.

What Type of Accounts Qualify for Accredited Debt Relief?

$10,000 or more in unsecured debt is required to qualify for Accredited Debt Relief. Their average client has between $15,000 and $30,000 worth of debt, though some may have more. Accredited Debt Relief clients generally enroll 3-8 debt accounts into the program.

Although people with a lower credit rating may benefit more from Accredited Debt Relief, the company doesn’t require a specific credit score as a qualification requirement.

Eligible accounts include:

- Credit Cards

- Department Store Credit Cards

- Most Personal Loans

- Medical Bills

- Repossession Balances

- Most third-party collection accounts

Is Accredited Debt Relief Legit?

Yes, Accredited Debt Relief is a legitimate company. With a score of 4.8 on Trustpilot, including 3,700 positive reviews, most customers are very satisfied with their services.

In addition to these reviews, Accredited Debt Relief is accredited by the American Fair Credit Council (AFCC), and its counselors are all certified by the International Association of Professional Debt Arbitrators (IAPDA).

Reviews about Accredited Debt Relief from reputable sources:

- Rated 4.8 out of 5-Stars, as well as best for bankruptcy alternative in Consumer Affairs

- Rated 4.9 out of 5-Stars on TrustedCompanyReviews.com

- Rated 4.8 out of 5-Stars on BestCompany.com

Aside from the company’s credentials, let’s look at its debt relief service. Accredited Debt Relief offers a performance-based debt settlement program. That means, there are no fees even charged to the client until after settlements occur. So in other-words, you either get results or don’t pay a dime. A performance-based program is the safest and most legitimate type of debt relief service on the market. For example, let’s say you make three monthly payments to the company and then decide to cancel the program. If none of your creditors were settled yet, you’d get 100% of the funds paid into the program returned.

Accredited Debt Relief Pros

- A+ BBB rating from BBB site

- Excellent credentials; top-rated online, licensed, and FTC-compliant.

- Offers free consultation and credit report.

- Flexible monthly payment options to get out of debt in 12-48 months.

- Clients may qualify for a loan to help fund settlements and get out of debt faster.

- Charges no up-front fees. Clients only pay after a debt settlement is reached.

- In business since 2010

Accredited Debt Relief Cons

- Like all debt settlement programs, it can negatively affect credit scores because creditors are not paid monthly. Additionally, clients can get third-party collections and late marks on credit reports.

- Not all states are eligible.

- There is no guarantee that creditors will settle for a specific rate.

- Over $10,000 in debt is required. Secured debts do not qualify.

- A forgiven debt can be taxable, so consult a licensed accountant to see if this would apply to you.

When using debt settlement services, always understand a company’s policies around lawsuit defense. Reputable debt settlement companies are transparent about this subject and have experience dealing with it.

Does Accredited Debt Relief Hurt Your Credit?

In the short term, not paying creditors as agreed every month can have a negative impact.

Here’s why: most debt relief companies, including Accredited Debt Relief, will require you to stop making payments until settlements are completed. Since ”payment history” accounts for up to 35% of your credit score, your score may go down once you start the program. Late payments and collection accounts also get reported to credit bureaus. However, these will usually fall off your credit report after seven years.

As you continue to make your monthly payments, Accredited Debt Relief will slowly pay off your debts with your creditors, increasing your credit score over time. To summarize, yes, your credit score will dip in the immediate time after you set up a debt settlement program, but will begin to recover over the next two to three years as your debt is settled and paid.

NOTE: If you can comfortably afford to pay more than the minimum on your credit cards, debt settlement may not be advisable, as your credit scores can be negatively affected.

How Much Does Accredited Debt Relief Cost?

Accredited Debt Relief charges a settlement fee of 15-25% of the original balance on a debt enrolled into their program. So, clients can save around 20-30% on their debt, including what creditors get paid.

However, if you compare what you’re currently paying against the total cost of Accredited Debt Relief, the savings can come out to much more. For example, when paying minimum payments, $10,000 in credit card balances with an average interest rate of 25% will cost $21,724 over the long term. Compare that to the total cost of Accredited Debt Relief, $7,500, and your savings can be over $14,000.

On average, clients must save approximately 40%-50% of each enrolled account before a bona fide settlement offer is made. On average, clients receive their first settlement within 4-6 months after being enrolled in the plan, and approximately every 3-6 months after that.

Source: Disclosure from Accredited Debt Relief’s website

Like any company you’re considering doing business with, ask for clarification before enrolling if you have questions about pricing or monthly fees.

Reviews on Accredited Debt Relief

- Accredited Debt Relief is accredited and A+ rated by the BBB with an average customer review rating of 4.82 out of 5 stars (based on over 245 customer reviews).

- Accredited Debt Relief was named “Best for Debt Settlement” by Investopedia, and received and “excellent” rating (4.9 out of 5 stars) from TrustPilot, with over 4440 reviews.

- Most of the reviews about Accredited Debt Relief feature positive comments about their customer service, the program, clients’ results, and the website. Many client reviews mention company team members by name, who went “above and beyond.”

- Our research found 19 BBB complaints from the past three years, and all were resolved. Criticism included the company’s occasional struggle with miscommunication; some mentioned confusion about pricing and a possible lack of transparency regarding monthly payments.

How to Cancel Accredited Debt Relief

To cancel the Accredited Debt Relief debt settlement program, submit the cancellation notice found in your enrollment agreement. Afterward, call their customer service department to confirm they received it and find out if any other steps are required to finalize their account’s cancellation.

There are no cancellation fees associated with canceling the Accredited Debt Relief program. In addition, any funds remaining in the client’s program account, where the funds accumulate for settlements, are owned by the client.

If you’re considering joining Accredited Debt Relief consider the following factors and questions:

- Fees: Debt relief companies typically charge fees for their services, which can vary depending on the type of service and the company. Does the company charge fees upfront? If they do, that’s illegal. Are the fees reasonable compared to what other similar companies are charging? Is the company being transparent about its fees? Accredited Debt Relief fees are around industry average and they don’t charge any fees until after a debt is resolved.

- Credibility: Research the credibility and reputation of any debt relief company you’re considering. Look for reviews from past clients and check with organizations like the Better Business Bureau (BBB) to see any complaints or lawsuits filed against the company. Accredited Debt Relief is licensed in every state they operate, highly rated at the BBB and has various certifications and accreditations as we’ll highlight in the following review.

- Services: Debt relief companies offer different strategies and programs, including debt consolidation, consumer credit counseling and debt settlement. Understand how these other options work, their effect on credit scores, how long they take to complete, the cost, and the pros and cons associated with each one. Understanding your options minimizes the risk of choosing the wrong plan. Accredited Debt Relief offers multiple options to help clients get out of debt faster and ensure the highest success ratio for their clients.

- Risks: Debt relief services can have risks, such as potentially damaging your credit score or facing tax consequences if debt is forgiven. Since creditors don’t get paid monthly, there is also the chance of getting sued. Ask questions about any risks associated with the services. The best debt relief companies are confident about discussing potential downsides with clients because they know how to help them deal with these situations most effectively, and it’s not a make-or-break type of deal.

Bottom Line: Accredited Debt Relief

Accredited Debt Relief is a top choice for debt settlement services, according to NoMoreCreditCards.com.

Disclosure: NoMoreCreditCards.com aims to provide the most factual information about debt relief, settlement, and consolidation reviews. Please email us at info@NoMoreCreditCards.com if any of the information mentioned above is incorrect. We are not responsible for the results of any program you choose to join. Therefore, always do your own research without relying on this or any single third-party review. Other reputable sources to check reviews about Accredited Debt Relief include the BBB, and the Attorney General office.