Prosper Loans Review:

Prosper Financial (legally known as Prosper Marketplace, Inc.) is a lending platform that originates loans through WebBank, an FDIC-insured bank. However, after loans are originated, WebBank sells the loan back to Prosper, who then sells the loans to investors.

The investors can pick the loan applicants they want to invest in, depending on whether they want to invest in a high-credit or low-credit applicant. With the stock market having very little upward movement over 2022 and 2023, investors have been anxious to find higher returns elsewhere.

As a result, Prosper has seen significant growth in the last few years, with over $15 billion in funding captured through their lending program.

Is Prosper a legit loan company?

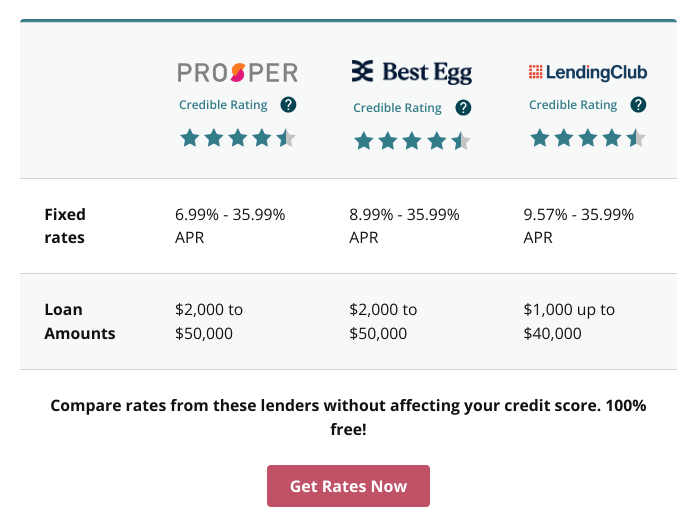

In this Prosper Loans review, we’ll help you determine if Prosper is your best route to apply for a personal loan. The quick answer is that Prosper is a legitimate personal loan company, but you’d be better off applying for a Prosper loan through the Credible Marketplace.

With Credible, you can compare Prosper vs. LendingTree and many other top-rated lenders for free, with no adverse effect on credit scores.

The True Cost for Prosper Personal Loans

Prosper loans come with two sets of fees.

Prosper charges an APR (i.e., your interest rate), and on top of that, borrowers pay loan origination fees that can often add another 3-6%, and it’s an upfront fee.

What is Prosper’s loan origination fee and who pays it?

If you borrow $10,000 from Prosper, you’ll receive around $9,500 of that loan.

The other $500 goes straight to Prosper’s loan origination fees at the time of funding, up-front. This is a significant downside of using Prosper over other lenders.

For this reason, we recommend always using one of the reputable free online marketplaces that allow you to compare loan rates, terms, and payments before committing to a loan.

Credible is top-rated in this arena because they work with the best lenders, and Credible doesn’t charge consumers a dime. Instead, Credible gets paid by the lenders that use its marketplace to find borrowers. Credible is owned by Fox, the same company that owns Fox News.

Compare Prosper Loans vs. Other Top-Rated Lenders for FREE

So, the actual cost of a Prosper personal loan is more than what your eyes will see at a glance. Read the small print, and you’ll realize that the actual cost of a $10,000 loan looks something along the lines of:

“A three-year $10,000 personal loan would have an interest rate of 11.74% and a 5.00% origination fee for an annual percentage rate (APR) of 15.34% APR. You would receive $9,500 and make 36 scheduled monthly payments of $330.90. A five-year $10,000 personal loan would have an interest rate of 11.99% and a 5.00% origination fee with a 14.27% APR. You would receive $9,500 and make 60 scheduled monthly payments of $222.39. Origination fees vary between 1% and 5%. Personal loan APRs through Prosper range from 6.99% to 35.99%, with the lowest rates for the most creditworthy borrowers. Your actual rate depends on credit history, income, loan term, and other factors. Eligibility for personal loans up to $50,000 depends on the information provided by the applicant in the application form. Eligibility for personal loans is not guaranteed, and requires that a sufficient number of investors commit funds to your account and that you meet credit and other conditions. Refer to Borrower Registration Agreement for details and all terms and conditions.”

Prosper offers more options than a bank:

Rather than applying for a personal loan with a bank or financial services company, Prosper’s loans are more attractive because they come with flexible terms, fast funding, and low-interest rates.

Since there are different types of investors, some looking for high-risk while others are looking for low-risk investments, that leaves borrowers with more options; borrowers have a better chance of qualifying for a personal loan with Prosper since there are more lenders than a single bank.

There often needs to be more clarification about how Prosper Financial works. People often misunderstand that the investors originate Prosper’s loans.

Is Prosper a reputable loan company?

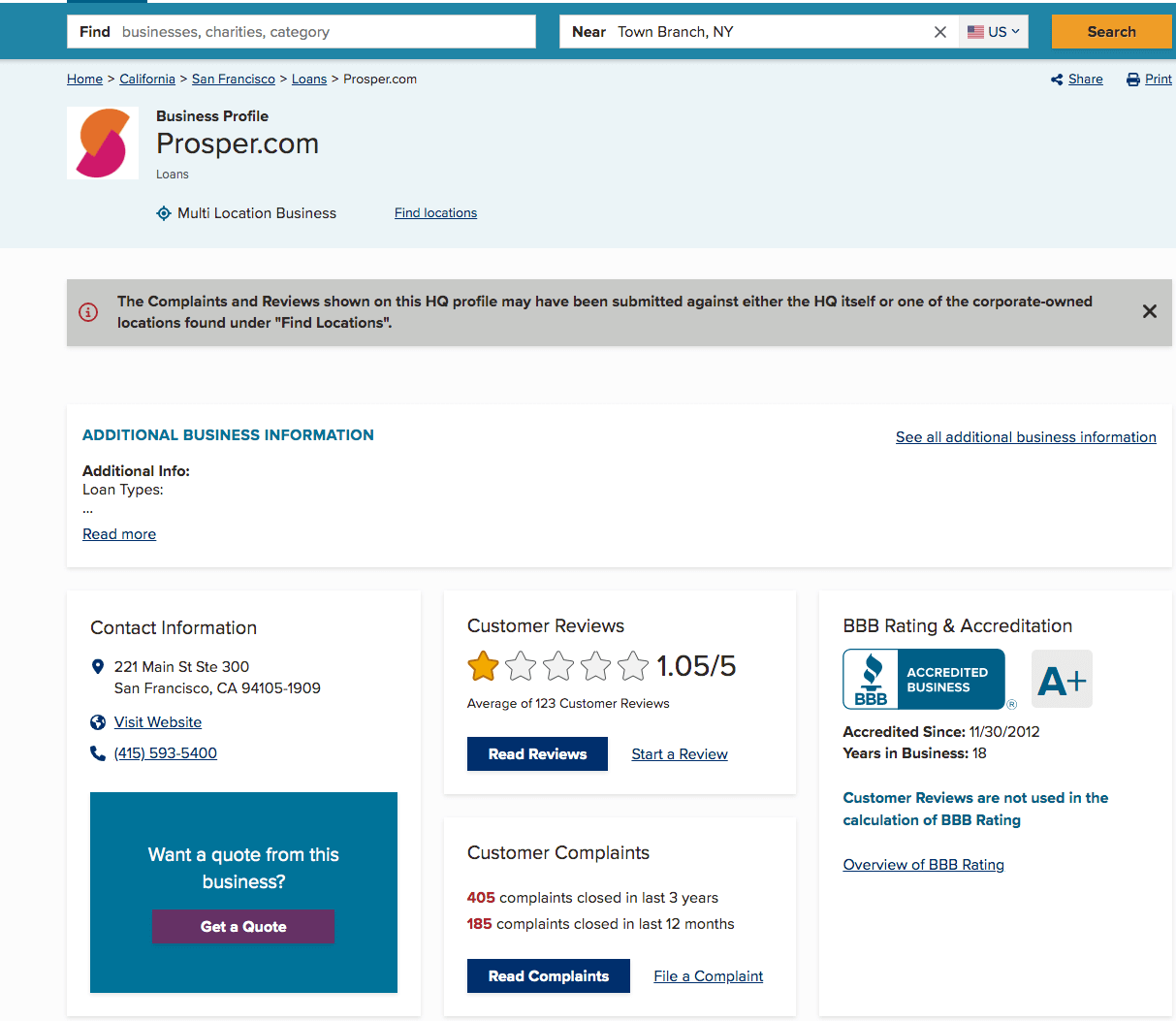

Prosper Financial holds Mortgage Brokers and Consumer Lenders Licenses in all states it operates. The company is accredited and A+ rated by the Better Business Bureau (BBB).

Prosper Loan Reviews BBB

Prosper loan reviews at the BBB have an average customer rating of 1.05/5. That’s a poor customer rating.

Additionally, there are over 400 complaints registered against Prosper.com at BBB.

Details of Prosper BBB Complaints:

Here’s a summary of 8 Recent BBB complaints about Prosper:

1. Identity Theft Inquiry (08/14/2023):

A customer suspects an unauthorized inquiry on their credit report by Prosper. They want Prosper to confirm there was no inquiry and remove it. Prosper is investigating.

2. Unauthorized Card Charges (08/11/2023):

A customer disputes charges by Prosper Card Services, claiming they never received a card or statements. Prosper found no fraud but advises contacting the new account holder.

3. Delayed Payment Processing (08/11/2023):

A customer made a payment but didn’t receive credit promptly, citing Prosper’s 5-day processing delay. Prosper is investigating.

4. Misleading Refinancing Inquiry (08/08/2023):

A customer received a letter from Prosper after considering refinancing and believes they were misled about the inquiry. Prosper explains the letter’s purpose and asserts no hard inquiry was made.

5. Autopay Turned Off (08/08/2023):

A customer’s autopay was deactivated without notice, resulting in late fees. They seek a waiver of these fees. Prosper offers to remove negative reporting but the customer rejects it.

6. Account Information Update Delay (08/03/2023):

A customer requested account updates through customer service, which were delayed but eventually processed by Prosper.

7. Missing Credit Card (07/21/2023):

A customer was approved for a Prosper credit card but never received it. They found customer service unhelpful. Prosper acknowledges the issue and states the most recent card has been activated.

8. Excessive Fees (07/17/2023):

A customer believes Prosper charges excessive fees and employs unfair credit practices. Prosper explains minimum payment calculation and waives the Annual Fee.

Types of Prosper Loans

Prosper loans can be used for debt consolidation, home improvement, healthcare refinancing, household expenses, and vehicle purchases.

According to Prosper; “Prosper is the FIRST peer-to-peer personal loan lending platform in the US. This means that a personal loan through Prosper comes from traditional investors and a unique group of real people choosing to invest in YOU.”

The benefits of getting a loan through Prosper vs. Bank Loans:

- According to customer reviews, Prosper’s peer-to-peer lending model offers loans with lower interest rates compared to what a bank would offer. Rates range from 6.99% – 35.99%. Investors are competing against banks, so they realize they need to offer attractive rates.

- What is the minimum credit score for a loan from Prosper? Prosper’s loan underwriters look at more than just a person’s credit score to determine eligibility, resulting in consumers with credit scores as low as 640 being approved for a personal loan.

- Are Prosper loans fixed? Aside from this, Prosper’s loans come with a fixed rate. This is a benefit because you don’t have to worry about your rate and payment rising over time as the Federal Reserve continues to raise interest rates to fight inflation, as of the case over 2023.

- You have flexible payment terms to choose from. Consumers can repay Prosper loans in anywhere from 2-5 years.

Downsides of Prosper Personal Loans:

- Prosper’s loans include origination fees that cost 2.4% to 5% of the loan balance. These fees are on top of the interest rates you’ll be paying. Loan origination fees are up-front fees. At NoMoreCreditCards.com, we recommend personal loans that don’t have loan origination fees.

- Availability of the loan is another potential issue. Since investors are the ones funding Prosper loans, if there aren’t any investors interested in a particular loan, that may result in the applicant getting rejected for the loan or there being a delay in funding the loan.

How to apply for Prosper Personal Loans:

The best way to apply for a loan through Prosper is using Credible. You can find the simple instructions inside this Credible Loan Review.

We recommend using Credible to apply for a Prosper loan because you’ll get multiple loan offers presented to you for free. Credible gets you pre-approved loan offers without negatively affecting your credit or having to commit to any lender. After checking loan rates and terms, then pick your best loan option.

Investing with Prosper

For investors, Prosper makes it easy to get started.

- Open a Prosper account and connect it to your bank.

- Pick the investments presented to you by Prosper. You can choose between AA (safe loans with low return) or HR (High Risk with higher return).

- Earn passive income off the interest paid by borrowers. On average, investing through Prosper Financial pays 3.6% – 8.2% (i.e., their historical average return).

Is it easy to get approved by Prosper?

It’s easier and faster to get approved for a Prosper personal loan compared to using a bank. The terms are more flexible and bad credit consolidation loans are available.

Source: Prosper.com/Personal Loans, https://www.prosper.com/personal-loans and https://www.prosper.com/legal/heloc-licensing-disclosures.

Sources:

Prosper.com/Personal Loans, https://www.prosper.com/personal-loans and https://www.prosper.com/legal/heloc-licensing-disclosures.

BBB, Prosper’s BBB Review, https://www.bbb.org/us/ca/san-francisco/profile/loans/prospercom-1116-118427, 09/03/2023

About the Author: