Is Grace Loan Advance a legitimate lender?

This Grace Loan Advance review provides details about the company, whether it’s a licensed lender and other relevant information you’ll want to consider before applying for a loan!

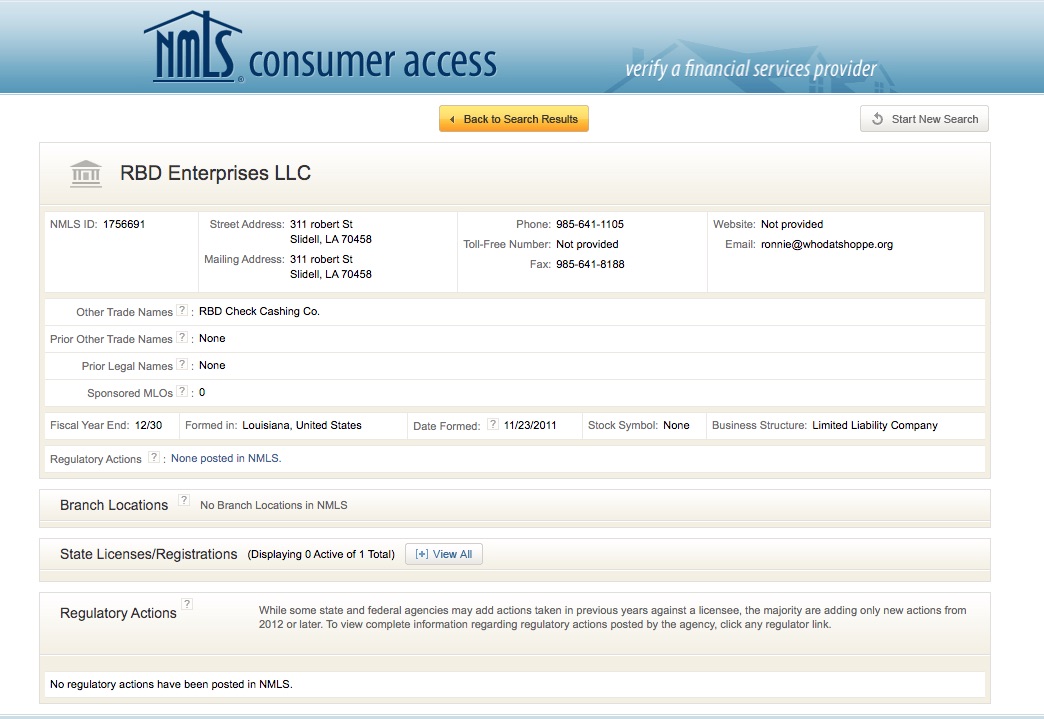

Grace Loan Advance, owned by RBD Enterprises, Inc., is a legitimate lender according to the Nationwide Mortgage Licensing System (NMLS), an online database where lenders are licensed. RBD Enterprises LLC holds an active license (NMLS ID: 1756691).

How to confirm whether a lender is licensed and check it’s complaints:

Visit https://www.nmlsconsumeraccess.org and search for any company by name, address, NMLS ID, or license number if the company gives you one.

You may find other information through NMLS that is highly relevant to whether or not you should use a particular company. For example, NMLS also lists any other company names that a company is affiliated with.

NMLS shared that RBD Enterprises LLC also operates under the name RBD Check Cashing Co.

Is RBD Check Cashing legit? It has a rating of 3.4 out of 5 stars on Yelp, but besides that, you won’t find much about this company online.

Are there better options to consider over Grace Loan Advance?

- Check out Top-Rated Personal Loans for Fair Credit on TrustedCompanyReviews.com.

- For debt consolidation, Accredited Debt Relief is one of the best companies to work with.

- Credible offers a similar service to Grace Loan Advance, except it has a much better reputation and offers top-rated loans. Compare loan offers and rates on Credible for free.

- Check out more debt consolidation reviews on NoMoreCreditCards.com.

Grace Loan Advance Reviews: User Feedback and Concerns

Grace Loan Advance claims to operate under a strict set of fair and responsible lending policies. However, according to user feedback across various forums, including Reddit, opinions about the company are mixed.

Some users question its legitimacy, citing concerns such as a lack of direct contact numbers and experiences of submitting personal information without receiving a loan in return.

Even a simple Google Search for “Grace Loan Advance reviews” pulls up very little information about the company.

Its website doesn’t even come up at #1 on Google, indicating that the company lacks a strong online presence.

Unfortunately, Grace Loan Advance does not have a BBB review. We searched the Better Business Bureau, and no profile exists for this company.

Is Grace Loan Advance a direct lender?

The company emphasizes that it is not a lender itself but acts as an intermediary between borrowers and lending partners. It adheres to federal lending laws, such as the Equal Credit Opportunity Act (ECOA) and the Truth in Lending Act (TILA), to protect consumers against discriminatory practices and ensure full disclosure of loan terms.

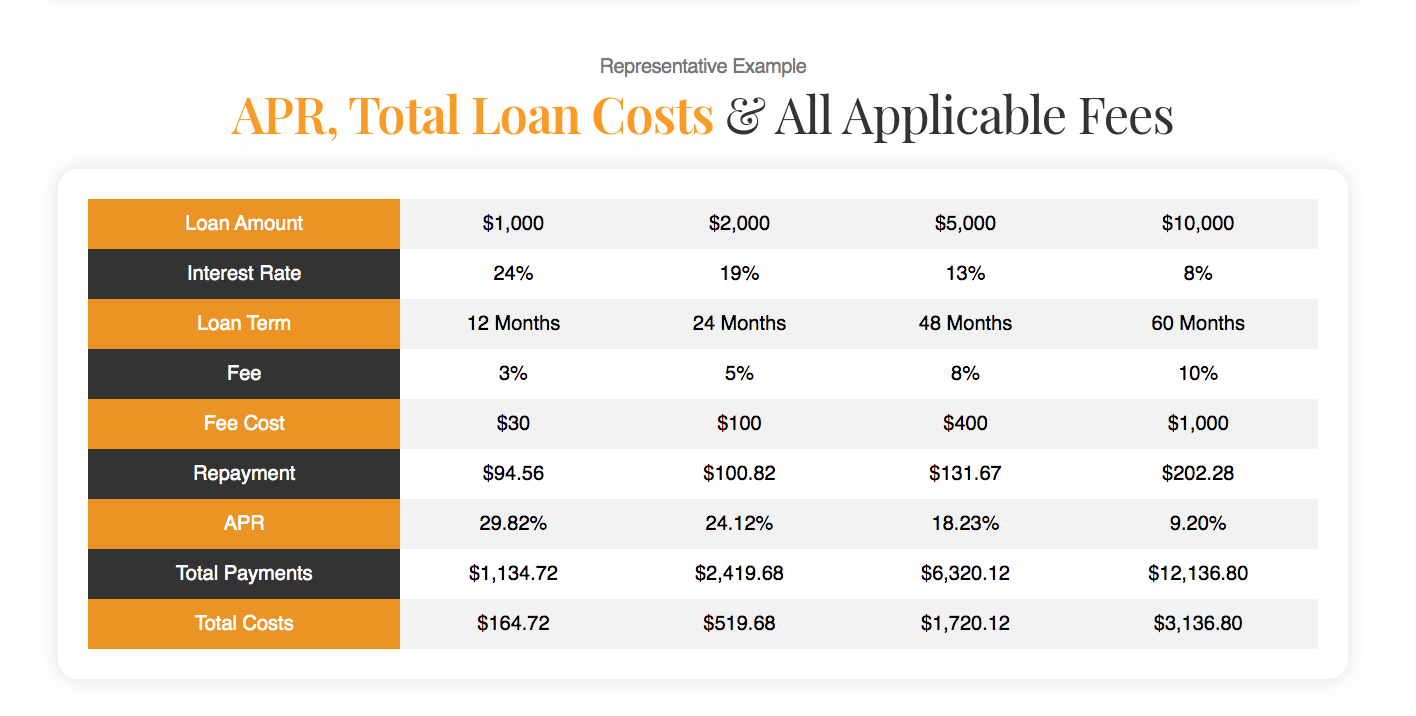

Grace Loan Advance Rates and Fees

Grace Loan Advance states that all lenders in its network must provide transparent terms regarding APR, fees, and repayment schedules before you commit to a loan. However, Reddit users have shared experiences where loans were promised but never fulfilled, which raises concerns about whether these lenders always act in good faith.

The Fair Debt Collection Practices Act (FDCPA) is also upheld by Grace Loan Advance, ensuring that lenders cannot engage in harassing or unethical collection practices. However, the company’s role is limited to connecting borrowers with lenders, and it is not involved in debt collection directly. Therefore, borrowers must review the terms provided by individual lenders to understand the consequences of late or non-payment, including potential penalties, fees, and impacts on credit scores.

While Grace Loan Advance complies with federal lending guidelines, users have noted the company’s weak online presence. Even a basic Google search for “Grace Loan Advance reviews” brings up limited information, and the company’s website does not rank highly in search results. This lack of visibility and transparency has caused some to remain cautious when considering loans through this platform.

Final Thoughts: Should You Trust Grace Loan Advance?

Grace Loan Advance claims to follow fair lending practices, but it’s essential to proceed with caution. Users have raised concerns about incomplete loans and limited customer support, which can be significant red flags.

Always ensure that you fully understand the terms provided by any lending partner before sharing sensitive financial information. Additionally, it’s a good idea to research each lender individually to verify their legitimacy and reputation.

When it comes to finance, a company’s reputation, time in business, and customer reviews all matter. Keep in mind, this company will be accessing your personal information, including your social security number, before giving you a loan. Therefore, if you have any doubts about a financial company’s reputation, avoid doing business with that company. It’s just not worth it.

Regarding Grace Loan Advance, whether or not you do business with this company is up to you!

However, here are some other personal loan companies that we recommend over Grace Loan Advance;

- Upstart

- LendingClub

- LightStream

- LendingTree

- OneMain Financial

- Credible

Company details:

- graceloanadvance.com is run by RBD Enterprises, LLC.

- Address: 4470 W Sunset Blvd #91234 Los Angeles, CA 90027

- Telephone Number: (424) 317-8925

- Email Address: info@graceloanadvance.com

- NMLS ID: 1756691