How Does a Debt Settlement Service Work?

Debt settlement services can help you pay off almost any type of unsecured debt. A debt settlement program’s negotiators negotiate the settlement on your behalf, reducing your balances while your job is to simply make your single payment every month and forward any creditor communication to the company. As a result, you only pay a small fraction of the total balance owed on each unsecured debt, including fees and interest.

Alternatively, consumer credit counseling services (CCCS) reduce just the interest rates (with no balance reduction). There are benefits of CCCS over settling your debt, such as less of a negative effect on credit scores. If you’re interested in comparing debt settlement versus consumer credit counseling, you’ll definitely want to give our Free Consumer Credit Counseling Services Guide a quick read – includes details on the cost of CCCS, along with pros and cons.

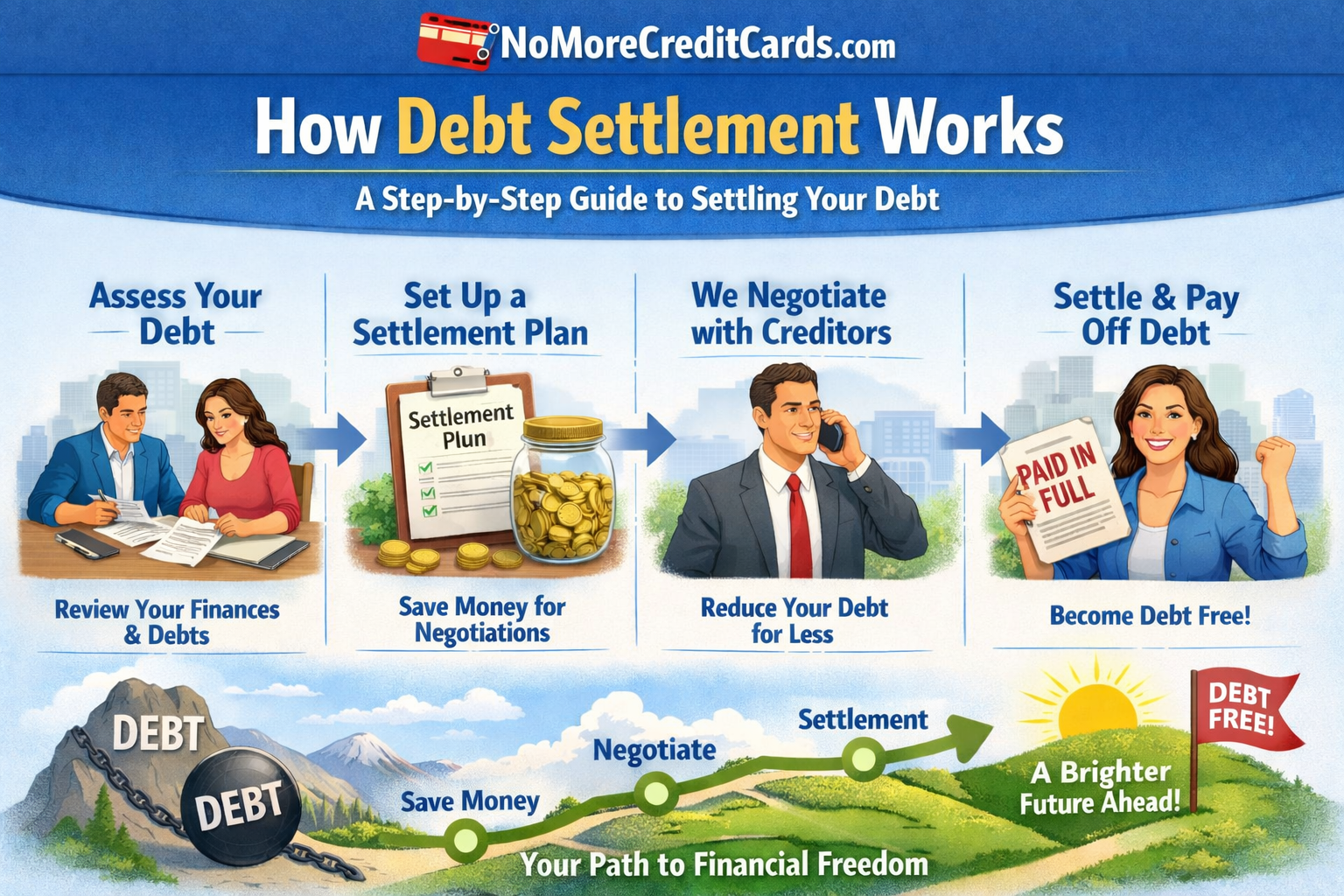

Here are the typical steps involved in a debt settlement service:

- Free consultation: The debtor provides information about their debts to the debt settlement company, including the amount owed, the creditor(s) involved, and the debtor’s financial situation. Companies often offer to retrieve your credit report by doing a soft pull, making it easy to determine what creditors qualify for the program. All this is done through a free consultation.

- Savings plan: Based on the debtor’s financial situation, the debt settlement service develops a savings plan to set aside funds for future settlements (i.e., also known as your “monthly payments”).

- Negotiation: After approval for the program and making at least 3-6 monthly payments, the debt settlement company will start contacting creditors to negotiate a settlement. This may involve multiple rounds of negotiations and may take several months to complete.

- Settlement: If a settlement agreement is reached, the debtor will pay a lump sum to the creditor(s) in exchange for forgiving a portion of the debt. The company charges and earns its fee at that point, which is typically a percentage of the amount saved through the settlement or the total balance owed.

- Repayment: One by one, each debt is negotiated down, settled, and paid. The process continues until the client is debt-free.

Benefits of Debt Settlement Services

- Balances get reduced, allowing you to pay off your debt for less than you owe and save money.

- Get one comfortable monthly payment.

- Become debt-free in 24-48 months on average.

- Avoid bankruptcy, which has a more significant negative impact on a person’s credit report.

Debt Settlement Program Downsides

- Can lower credit scores and leave late marks and collection accounts on the credit report.

- Creditors can issue a summons over an unpaid debt and attempt to sue the debtor. Although, debt lawsuits can be resolved and even dismissed in some cases. A judge from Brooklyn recently released a report that illustrated 90% of these credit card judgments being inaccurate and flawed.

- Creditors continue to charge late fees and interest after clients enroll in the program, resulting in balances increasing before getting settled.

- Not all clients will graduate from the program due to insufficient income. Some clients may end up canceling settlement services and resorting to bankruptcy.

- Creditors may not agree to settle because they don’t have to, and no company can guarantee a rate any creditor will agree to resolve a debt at.

What happens after getting approved?

Clients get set up with a single and affordable monthly payment – whether they have one or five unsecured debts. Even though creditors are not paid monthly, clients get a single monthly payment that accounts for all their debts.

Each month as they make that payment, the funds accumulate in a special program account, similar to a savings account. Clients are in total control of their program savings accounts. They own it, just l like a regular savings account. The main difference between this account and a standard savings account is that the client and debt negotiators can monitor it, seeing how much is available at all times to negotiate and obtain settlements.

When enough funds accumulate in this account, negotiations begin. And before a creditor gets settled and paid, all settlement offers are brought to the client, who must either approve or reject it. So again, ultimately, you’re always in control of your money. The only funds in this account that the settlement company is authorized to touch is their program fee, which only gets charged after settlements.

Settlement Example Letter:

Typically, settlements can significantly reduce debt, but the results vary.

- Once approved for the program, all creditors get notified.

- Your reduced monthly payments will start.

- If your creditors have any questions, they can contact the debt negotiators.

- When your creditor agrees to lower the balance, customer service will immediately send you the “written offer” to review.

- After you approve the settlement offer, the funds are released from your program account and paid to the creditor.

- One by one, each collection account is negotiated down and resolved.

What is the Best Debt Settlement Company?

It is essential to check debt settlement service reviews before signing up with a company.

Debt relief, settlement, and consolidation companies often charge high fees and only sometimes perform up to par. Consequently, debt negotiation companies are often stereotyped and have a bad reputation. However, like in any industry, there are good and bad companies.

Check out the Top 20 Best Debt Relief Companies for 2023 here.

Talk to an IAPDA Certified Counselor Toll-Free at (877) 332-8007

FAQs:

Do my creditors get paid monthly?

Your creditors are not paid out of your monthly payment. Instead, your monthly payment amount gets deposited into a savings account that you control.

As your funds accumulate in your program account, the debt settlement negotiators go into action. One by one, your accounts will get settled and paid off, and before you know it – you’ll be debt-free.

Creditors get paid in one lump sum after agreeing to reduce the balance to a fraction of the total owed. Settlements can be as low as 30-40% and up to 60-70% or more before company fees, saving consumers, on average, around 25% discount off their balance.

Do debt settlement companies work?

Settling debt has been around for over fifty years. Before debt settlement services were available, banks had a settlement department that would contact consumers who had fallen behind on payments and offer them to settle the debt for less than what they owed.

As of 2023, strict laws and regulations have been enforced to protect consumers from financial fraud and unreputable companies. For example, debt settlement services can legally charge fees until they settle a client’s debt, ensuring they perform the services before getting paid.

You should also check online reviews about a company. Only work with a highly rated company at the Better Business Bureau (BBB). Also, check to be sure a settlement company is accredited by the International Association of Professional Debt Arbitrators (IAPDA).

Debt Settlement Services Fees and Cost:

The fees charged by debt settlement companies can vary widely depending on the specific company and the services offered. Generally, debt settlement companies charge fees based on a percentage of the total debt enrolled in their program or a flat fee per account. However, some companies charge a percentage of the amount saved for the client equaling up to 50% of the savings.

According to the Federal Trade Commission (FTC), debt settlement companies are prohibited from charging upfront fees before settling a debt. However, they may charge a fee once a debt has been settled.

The average fee charged by debt settlement companies ranges from 15% to 25% of the total debt amount enrolled in the plan. For example, if a debtor has $20,000 in credit card debt, settlement programs could charge around 20% as a fee. The total cost would be $4,000. Debt settlement lawyers and attorneys may charge even higher amounts.

It’s important to note that fees can add up quickly, and debt settlement companies may not be the best option for everyone. Therefore, debtors should carefully consider their options and seek advice from a financial professional before enrolling in a debt settlement program.

Reputable debt settlement service providers like Beyond Finance will only charge fees after a debt is reduced and settled.

How Much Does a Debt Resolution Program Impacts Your Credit Score?

Credit card settlement services require a person to stay caught up on monthly payments. Consequently, credit scores will go down.

You have to ask yourself, is your credit helping you right now? And if so, how?

Sometimes, a temporary negative effect on credit scores can be worth saving money and clearing your balances much faster using a debt resolution service.

Typically, a person’s credit score will decrease over the program’s first year. However, debt-to-income (DTI) ratios may improve as accounts get paid. The DTI is an important factor that illustrates whether you are creditworthy.

Once you finish the program, you can rebuild your credit score by getting new credit and staying current on future payments.

If you don’t want your credit score negatively effected, you must explore your options before deciding on a credit card negotiation program. First, consider restructuring your debt payments to help pay off the balances faster, using either the debt snowball or avalanche methods. You can also compare debt consolidation lenders and consumer credit counseling companies.

Talk to an IAPDA Certified Counselor Toll-Free at (877) 332-8007

- Check out this Review on American Consumer Credit Counseling

- Check out Consolidated Credit Solutions Reviews

RULES to Follow When Using Debt Relief Services:

-

- Only sign up with a company that has been in business for five years or longer. And don’t just take their word for it; look up their time in business at either the BBB or Secretary of State website.

- Only sign up with a company that clearly explains that there is a chance you could get sued while on the program. Also, ensure the company has a plan of action or lawsuit defense to assist you with the debt if a creditor issues a summons.

- Make sure the company has an A+ Rating with the Better Business Bureau.

- The program should last for no more than 48 months. A debt negotiation company should not offer consumers a six- or seven-year plan (RED FLAG), so if they offer you this long program, refrain from doing business with that company.

- Debt arbitration companies should only collect settlement fees after accounts are “paid off” and not upfront. (a performance-based fee). Avoid companies that charge fees before settlements occur, no matter what their reason for doing so is.

- What kind of customer service do they have? Be sure you can call in and speak with an experienced customer service representative or legal assistant when you have questions about your settlements or program. Call in frequently after you sign up for the program, and make sure you can easily talk to an agent. You can cancel the program immediately if the company only has a few employees working in customer service.

- During the program’s first month, the debt negotiations or law firm should contact your creditors. You should receive instructions on how to access your account online. The company should provide you with a welcoming package and a welcoming phone call to go over your welcome package and any questions you may have. The company should educate you on handling creditor phone calls, what to do with and where to send collection letters when you receive them, and educate you on your consumer rights so that you can recognize when creditors violate them. If the company fails to provide you with this correspondence and information within the first 30 days after enrolling, cancel.

- The company should have ZERO UNRESOLVED BBB COMPLAINTS. Having a few complaints is acceptable as long as they are resolved. No government action should be listed against a company found on their BBB profile page.

- Check online at Google and Yelp for customer reviews. Only sign up with a company that has mainly positive online reviews.

- The company should have experienced counselors on the front-line that explain all options to consumers before enrolling them in a program. Consumers should get to pick from multiple choices and never get pressured into just one plan.

- Before joining a credit card relief, consolidation, or debt settlement service, ensure they are IAPDA certified and licensed for debt management or settlement services.

Debt Settlement Services Disclosures:

The following are possible implications and risks associated with a debt settlement service you need to know about.

- A debt negotiation program may hurt your credit score and result in legal action being taken against you. This is because your creditors are not paid as agreed and must become delinquent and eventually get sold to third-party collection companies before settlements occur.

- Your balances can increase after joining a debt settlement service due to creditors not getting paid monthly and interest, fees, and penalties accruing.

- Debt settlement companies may charge fees for their services, which can be significant and may not get fully disclosed upfront. Ensure any company you consider working with is transparent about the program’s cost and how its fees get collected. It is illegal for settlement services to charge fees before settlements occur.

- Debt reduction programs are not appropriate for everyone and should be considered carefully in consultation with a financial advisor or approved credit counselor. If you can afford to pay your accounts in full and as agreed, do everything you can to remain current on monthly payments and find ways to pay down your balances faster.

- Settlement programs may take several years to complete. Consequently, some of your creditors may not get paid for two years or even longer. One by one, each account gets negotiated, settled and paid. Meanwhile, your monthly payments do not go to creditors but get deposited into a savings account.

- The forgiven portion could be construed as taxable income when a debt gets settled for less than the total amount. However, many clients illustrate insolvency and never have to pay taxes due to a settlement. Consult with a licensed accountant about whether or not you’ll owe taxes on the amount saved through debt settlement services.